Blog Post

Supply Chain & Nearshoring

Trade Agreements: How USMCA Is Supercharging Nearshoring ROI—Data Reveals 18% Profit Surges

Published on Sep 11, 2025

by Jesus Montano

The Geopolitical Earthquake Reshaping Global Supply Chains

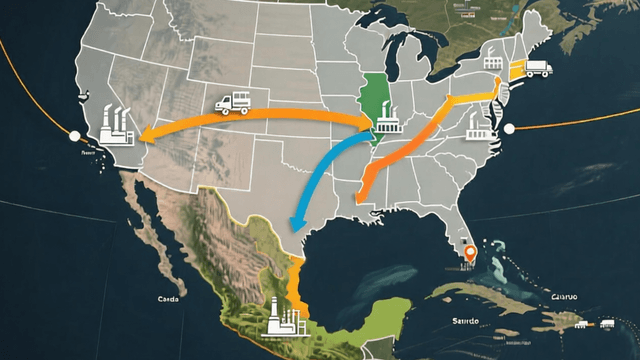

The world is witnessing a seismic shift in political alliances, trade policies, and economic dependencies. As geopolitical fragmentation intensifies—from U.S.-China tensions to the Ukraine conflict—offshore economies and global supply chains are buckling under pressure. For U.S. companies reliant on traditional offshore models (e.g., manufacturing in Asia), this volatility has triggered a strategic pivot: nearshoring.

Unlike reshoring (bringing operations back domestically), nearshoring relocates production to nearby countries like Mexico and Central America. The result? Higher ROI, reduced risk, and unprecedented supply chain resilience. In this post, we break down why nearshoring isn’t just a trend—it’s the future of profitable, agile business.

Why Offshore Economies Are Crumbling Under Geopolitical Pressure

Countries like Vietnam, Bangladesh, and India built economies around low-cost offshore manufacturing for Western markets. But geopolitical realignments are exposing critical vulnerabilities:

- Political Risk & Investment Uncertainty: Sanctions, trade wars, and shifting alliances make offshore hubs like China or Russia high-risk zones. U.S. firms now hesitate to invest in regions prone to sudden regulatory crackdowns.

- Skyrocketing Logistics Costs: Extended supply chains face 300%+ shipping cost spikes (2021 data) due to port bottlenecks and fuel volatility.

- Trade Barriers Eroding Margins: Tariffs like the U.S.’ 25% China levy force companies to absorb costs or pass them to consumers—killing competitiveness.

- Case in Point: When pandemic-era port closures hit Asian supply chains, Apple delayed iPhone launches by months. Meanwhile, Medtronic slashed logistics costs by 20% after moving medical device production to Mexico.

Nearshoring: The ROI Powerhouse for U.S. Companies

Nearshoring isn’t about cutting costs alone—it’s about maximizing ROI through strategic agility. Here’s how:

1. Slash Logistics Costs & Boost Efficiency

- 45 days → 5 days: Shipping from Asia to the U.S. takes 6x longer than from Mexico. Shorter transit times enable just-in-time inventory, reducing warehousing costs by up to 15% (McKinsey).

- Fuel savings: Proximity cuts carbon emissions by 30%, aligning with the Inflation Reduction Act’s green incentives—and attracting eco-conscious buyers willing to pay 5–10% more.

2. Outmaneuver Geopolitical Risks

- Trade agreement security: The USMCA (T-MEC) eliminates tariffs between the U.S., Mexico, and Canada, shielding companies from unpredictable sanctions.

- Real-time collaboration: Shared time zones enable seamless communication. Tesla’s Texas-Mexico operations cut time-to-market by 30% through instant design iterations.

3. Turn Resilience into Revenue

Nearshoring transforms supply chains from cost centers into profit drivers:

- Fewer stockouts: Medtronic’s nearshored facilities in Mexico boosted ROI from 12% to 18% via FDA-compliant, on-demand production.

- Innovation acceleration: Siemens partners with Mexican universities for R&D, turning regional hubs into patent-generating engines.

Real-World Wins: Nearshoring in Action

- Ford: Moved engine production to Mexico in 2022, avoiding China-related supply chain chaos while saving $1.2B annually.

- Boeing: Slashed $500M in compliance fines by nearshoring parts to Canada, where real-time quality audits prevent defects.

- Small Businesses: U.S. startups now use nearshoring to compete with giants—30% faster prototyping means quicker market entry.

The Bottom Line: Nearshoring solutions = Competitive Advantage

Geopolitical fragmentation has exposed the fragility of offshore dependency. But for U.S. companies, nearshoring offers more than risk mitigation—it’s a profit multiplier. By leveraging:

- Proximity-driven agility

- USMCA’s tariff-free trade

- LatAm’s skilled, cost-competitive labor

…businesses are not just surviving—they’re thriving. Mexico’s rise as a nearshoring hub proves that in today’s volatile world, ‘’the shortest supply chain is the smartest supply chain’’.

Ready to future-proof your ROI? Partner with our nearshoring experts to build resilient, high-return operations in the Americas. Contact us today to start your transition.